The story of the Luna and UST “stablecoin” tokens went bankrupt this week. At its peak, the Luna token had a market capitalization of ~$40 billion and people had purchased ~$18 billion of the UST token.

Now the Luna token is worth zero and UST trades at cents on the dollar. How could this happen?

Let’s digress from crypto and take a tour around traditional markets. We’ll borrow some charts from Ben Carlson at A Wealth of Common Sense to review a few recent capitulation of other overvalued stories.

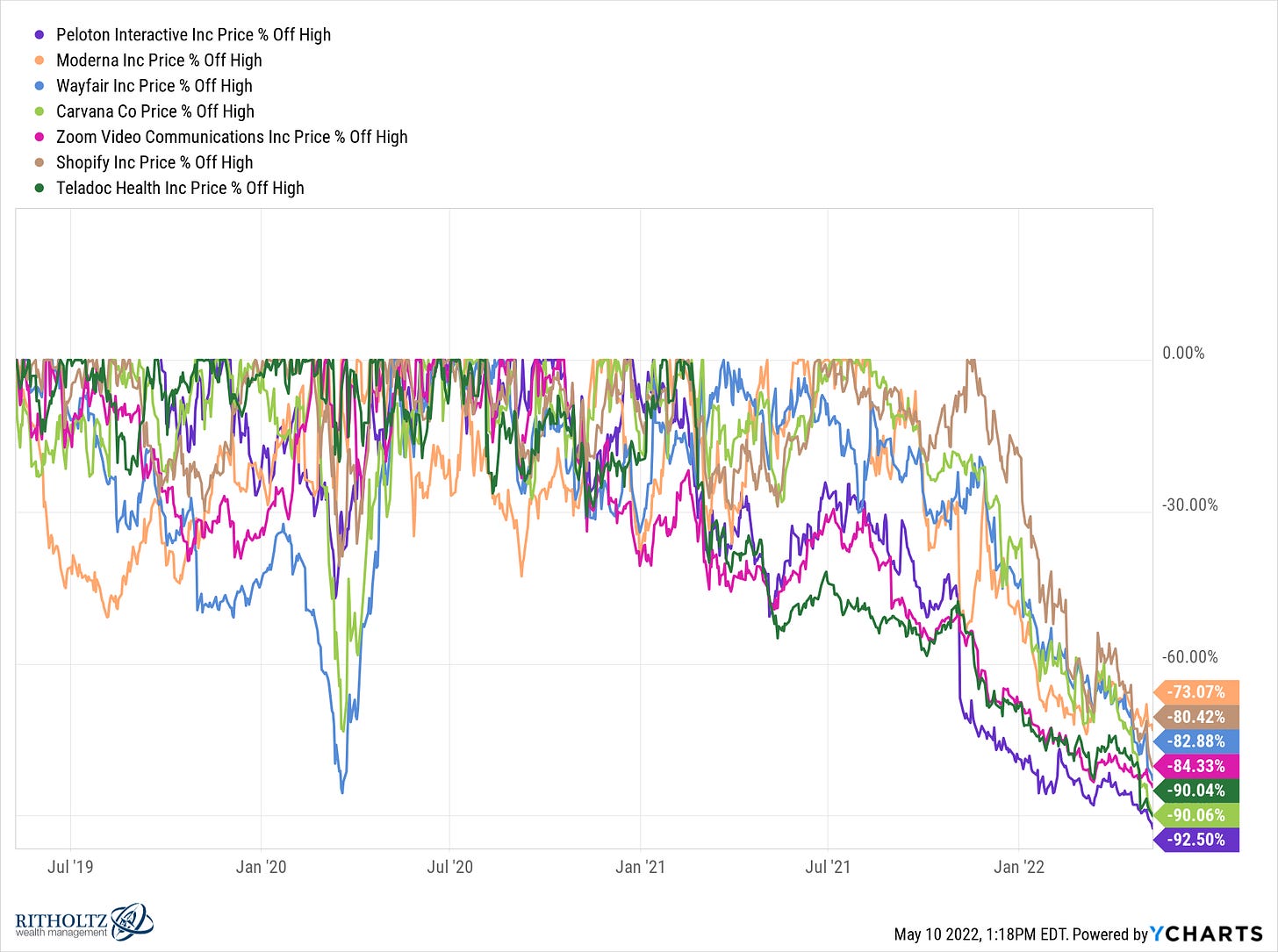

In 2020, we believed in the story of accelerated digitization. COVID showed us a new era ahead of remote work, digital application adoption and even the metaverse. While it’s true that things have changed, some people were willing to pay any price to participate in that story.

Paying any price for a story can lead to bad outcomes. For people who bought the digital economy story near the top, they’ve lost close to 90% of their money in certain names.

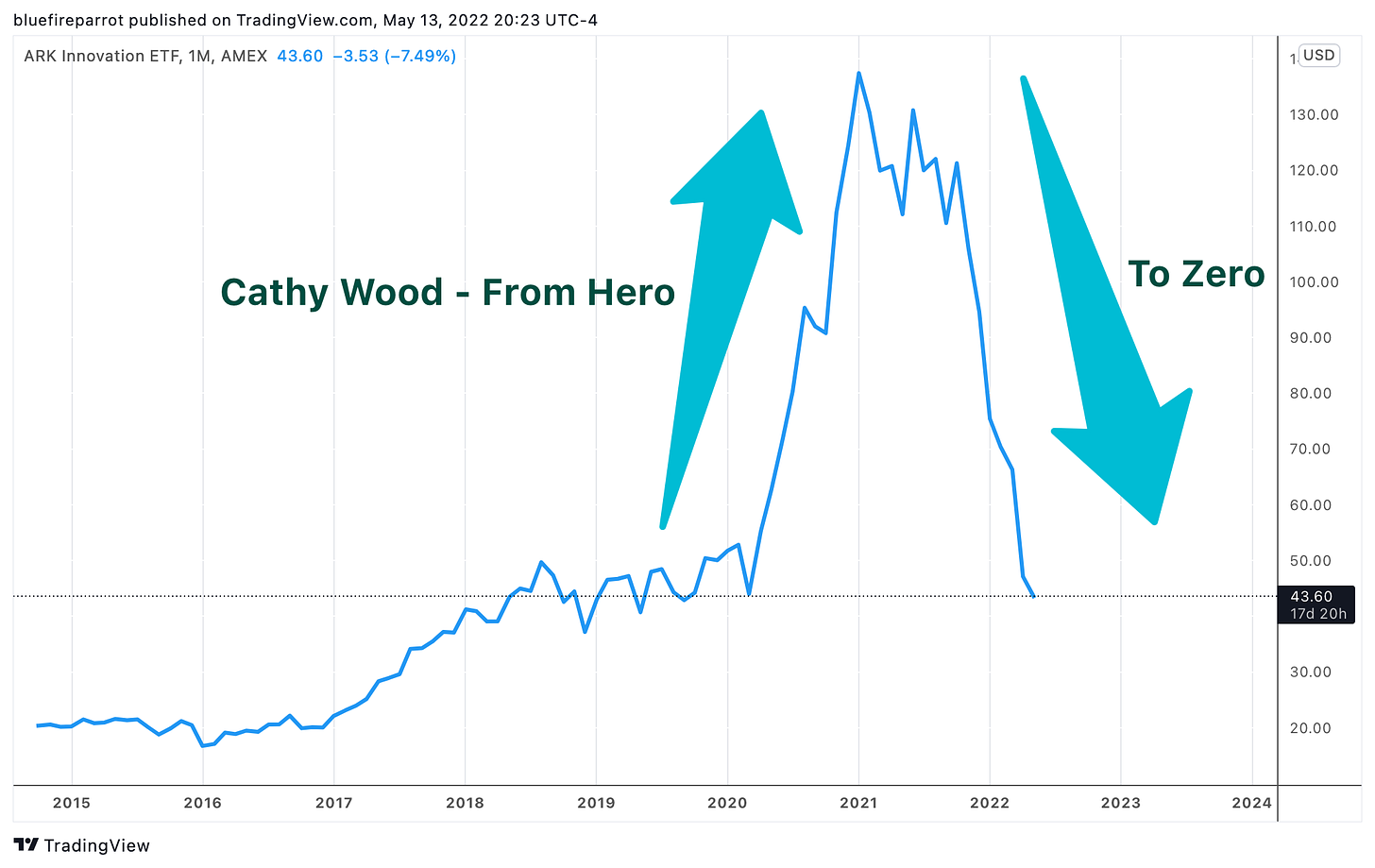

We also love hero stories. It’s why the Marvel movies are always such a great hit.

Queue in Cathy Wood - smart, charming fund manager who sees a different future ahead. Cathy was in every financial TV show and everyone’s superstar. For whoever purchased the ARK Innovation ETF at any price though, it’s been a rude awakening. Even smart investors who purchase - or keep in their portfolio - overvalued stories are subject to severe drawdowns.

We now return to the Luna and UST story. If you want to read a long version of how the UST peg worked along with the Luna token, you can check out this recent Bankless newsletter.

In essence, there was this token by the symbol of UST. It had limited to no collateral behind the token and its goal was to maintain the value of $1 through an algo. When the peg was falling below the desired $1 mark, a stability mechanism allowed people to always sell $1 of UST (even if UST was trading below $1) for $1 of the Luna token. The algo would also create any number of Luna tokens to get you that $1, meaning that the supply of Luna could increase to infinity in order to get you that $1. (Note: I’ve purposely left out the role of arbitrage players and burn/mint terminology for simplicity)

Now here is the crux: If you’re trying to leave this ecosystem, you take your $1 UST (that is trading at, say, 95 cents on the dollar) and swap it for the guaranteed $1 of Luna promised by the algo. At this point, you’ve even made free money by getting $1 in exchange for something that was trading at 95 cents. But then, you must sell your $1 of Luna to someone else if you’re trying to exit the whole system or don’t want to be subject to Luna price volatility. It may also be that your UST to Luna swap - guaranteed by the system - is greatly increasing the supply of Luna, creating downward pressure in the price of the token. Additionally, the more the Luna price goes down, the more Luna must be created in each subsequent UST to Luna swap.

When there isn’t “someone else” to take that Luna token from you, the whole thing collapses. That’s what happened this week. No one to hold the bag death spiral.

People had taken $18 billion of their money and converted to this UST token that would earn 20% per year. When a few too many people wanted to exit their UST position at the same time, nobody home.

While UST holders didn’t purchase Teladoc stock because of the post-COVID digital economy, they bought UST believing that there would always be someone else to buy their Luna token in the case of a de-peg below $1. They directly or implicitly believed in Do Kwon (the founder of the project), in the LUNAtic community and the resilience of uncollateralized, algo stablecoins.

The $18B of UST and the market cap of $40B in Luna all hinged on the idea that there would always be a sufficient amount of buyers to absorb people trying to exit the system. They believed in the algo and an endless amount of Luna buyers, no matter the situation at hand. A soft foundation for a $40 billion valuation. For context, there are probably only 500 companies in the world that are worth more than $40 billion.

There was nothing to backstop the value of the ecosystem when confidence failed.

The historical value of uncollateralized algorithmic stablecoins have typically been zero. Paying any price above it for that story has been generally disastrous over time.

While everyone is selling a story, good stories are not always good deals. It all depends on the price.

All opinions are my own. This is not investment advice.

Additional resources outlining the potential flaws of the UST/Luna system:

Article: Why I’m Betting Against TerraUSD

Tweet Storm: