Every January we pass around crystal balls. Smart people make sharp forecasts; most melt away by spring. The lesson is dull but durable: plausible isn’t the same as probable.

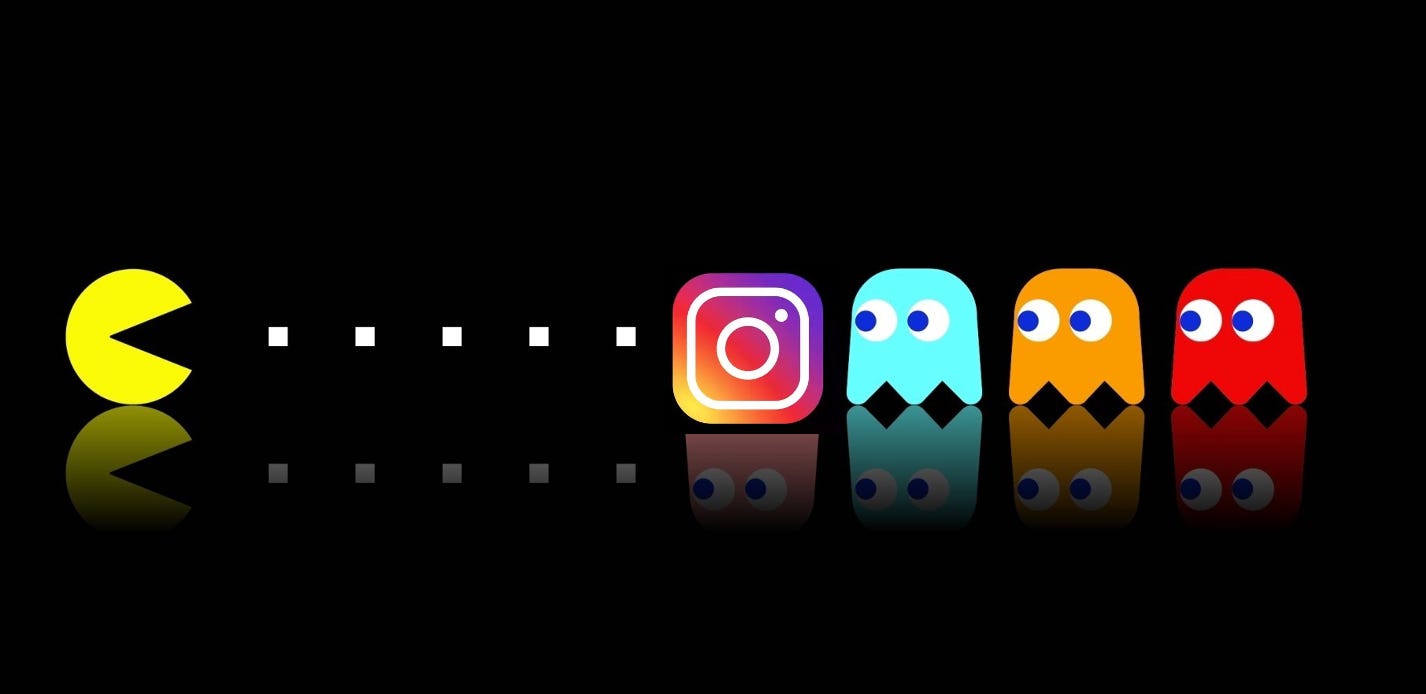

Still, predictions teach if you frame them as tipping-point hunts—places where slow curves threaten to turn vertical. That lens leads me to one for 2022: Instagram’s grip will loosen.

Tipping points, not novelties

Nothing truly new rocked crypto in 2021; what changed was pace. Digital-art NFTs dated back to 2017, but monthly volume on OpenSea went from “rounding error” to $2.5 billion in half a year. Something crossed a line.

The same pattern showed up in so-called Ethereum killers. High gas fees opened a side door; Solana, Avalanche, and Fantom rushed through. Network effects feel permanent—until a cost shock invites defection.

Undercurrents drag for years, then surface fast. That’s the setup for Instagram.

What Instagram has—and what it lacks

Product: filtered photos and tappable videos. Both are easily copied.

Moat: Two billion users. Attention begets more attention; the flywheel spins.

But only a sliver of those users make money. In 2020 Instagram booked $24 billion in revenue; almost none of it landed in creator pockets. That asymmetry worked when alternatives were scarce. Web3 could change the math.

The new toolkit

Blockchains with penny-cheap transactions (Solana, Fantom).

Rollup tech (StarkWare) that pushes costs even lower.

Communities already built around image-based assets—NFT holders eager to display and trade.

Add tokens that can share upside with early adopters and you have ingredients MySpace never saw coming.

Meta’s tell

Mark Zuckerberg rarely waits to be disrupted; he buys or copies the threat. Oculus, WhatsApp, Instagram—each was a pre-emptive strike. The sudden $10 billion metaverse bet and corporate rebrand shout the same message: the old feed might leak users.

How a replacement arrives

The new network probably won’t launch as an “Instagram killer.” It will start small and specific—the way Facebook began inside Harvard dorms. Maybe it’s a gallery where collectors flex NFT avatars. Maybe something weirder. Whatever it is, tokens will let early users own a slice of the upside, and that is a powerful magnet.

From there, concentric circles widen: a niche becomes a subculture, the subculture becomes a habit, habits steal minutes from the feed.

The shoot-out

On one side: lean, open-source teams armed with smart contracts and community tokens.

The other: a fortified incumbent with billions of users and mountains of cash.

Both believe they can keep your attention. Only one plans to cut you in on the revenue.

All opinions are my own. This is not investment advice. Re-written on May 18 2025